You can, however, claim dependent deductions on your Federal Tax Return. Unlike most states, New Jersey does not have a dependent deduction. The Federal Income Tax, however, does allow a personal exemption to be deducted from your gross income if you are responsible for supporting yourself financially. Keep in mind that not all deductions allowed on your federal income tax return are necessarily going to be allowed on your New Jersey income tax return. Certain itemized deductions (including property tax, qualified charitable contributions, etc) may be allowed depending on the income level and filing type of the taxpayer. Unlike many other states, New Jersey has no standard deduction. For details on specific deductions available in New Jersey, see the list of New Jersey income tax deductions.

Using deductions is an excellent way to reduce your New Jersey income tax and maximize your refund, so be sure to research deductions that you mey be able to claim on your Federal and New Jersey tax returns. Income tax deductions are expenses that can be deducted from your gross pre-tax income.

Ĭompare the state income tax rates in New Jersey with the income tax rates in

Nj business tax returns online for free#

The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. There are -677 days left until Tax Day, on April 16th 2020. Other New Jersey deductions and credits include the Earned Income Tax Credit (20% of your Federal Earned Income Tax Credit), military pension income, and certain retirement account contributions.

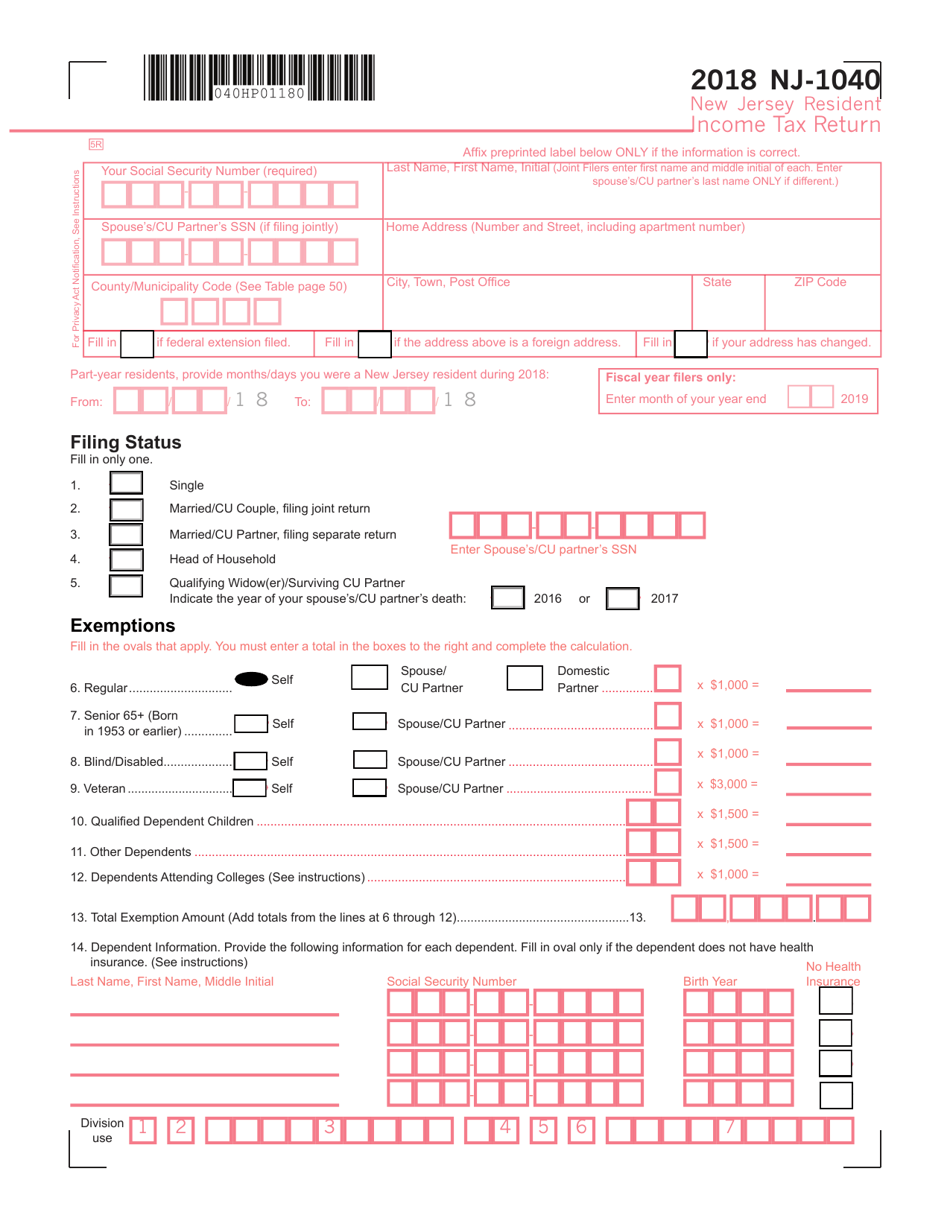

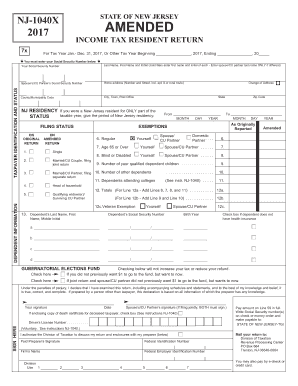

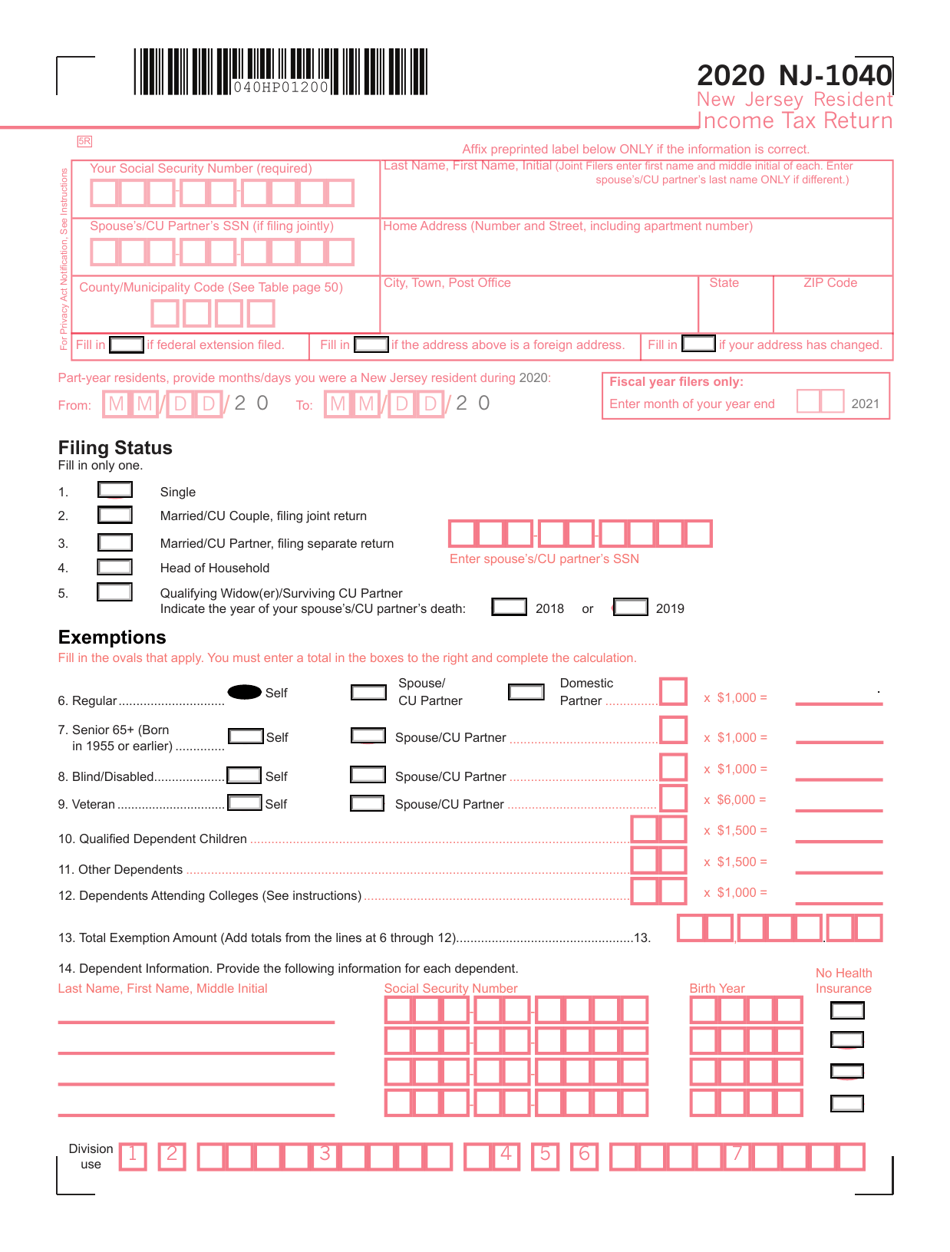

Note that in order to qualify for this rent deduction, your rental unit must have its own kichen and bathroom. If you rent an apartment or a house, you can deduct 18% of your yearly rent to cover paid property taxes. If you own your residence, 100% of your paid property tax may be deducted, up to $10,000. New Jersey has a special tax program that allows all residents to deduct as much as 100% of their property tax burden from their taxable income. If at least 80% of your expected tax liability has been paid through tax witholding or quarterly payments, you can file for a 6-month extension to submit your resident income tax return. If you do not pay enough estimated tax throughout the year, you may be required to pay additional interest - use Form NJ-2210 to calculate interest owed. You must submit estimated tax payments quarterly to New Jersey using Form NJ-1040-ES if your estimated tax owed exceeds $400 (taking witheld tax payments into account). Both full-year residents and nonresidents who meet these requirements and have earned income in New Jersey must file. You must file an income tax return with the New Jersey Division of Revenue of you are earned more then $10,000 in the preceding tax year (of more then $20,000 as couple or head of household). Who has to file a New Jersey Income Tax Return? You can learn more about how the New Jersey income tax compares to other states' income taxes by visiting our map of income taxes by state. New Jersey's maximum marginal income tax rate is the 1st highest in the United States, ranking directly below New Jersey's %. Unlike the Federal Income Tax, New Jersey's state income tax does not provide couples filing jointly with expanded income tax brackets. New Jersey collects a state income tax at a maximum marginal tax rate of %, spread across tax brackets.

0 kommentar(er)

0 kommentar(er)